News in Review: Saturday, April 1, 2023

Hi all,

I have decided to move this newsletter to a weekly cadence. This will allow me to spend more time on other AI-related projects, while still generating this weekly view of the news. You can expect to receive this newsletter every weekend.

As always, please let me know if you have feedback or suggestions on the newsletter.

Drew

What does the news landscape look like?

Trump’s indictment is by far the top story of the week. The school shooting in Nashville is in second place.

This is how the top stories were covered on each side of the media yesterday:

Trump indictment (29% more on the left)

Nashville school shooting (235% more on the right)

Banking turmoil (78% more on the left)

Media bias ratings are from AllSides.

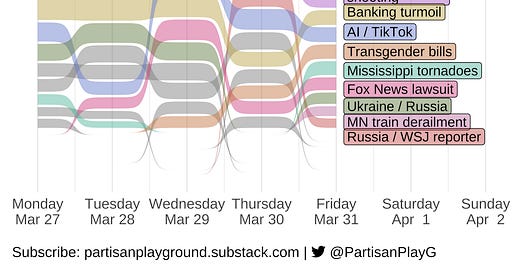

This is how articles from liberal and conservative outlets were distributed over the past five days among the top stories.

Liberal outlets used these words more than conservative outlets:

market (4x)

dominion (3x)

bank (2.7x)

Conservative outlets used these words more than liberal outlets:

hale (5.7x)

bill (1.8x)

school (1.7x)

What is happening in the top stories?

Now for a deep dive into our top three stories, starting with…

Trump indictment

Key people: Donald Trump, Manhattan District Attorney Alvin Bragg, Michael Cohen, Jim McKee, Joe Tacopina

Background:

Donald Trump has become the first former U.S. president to be charged with a crime related to hush money payments made on his behalf during his 2016 presidential campaign.

There are four ongoing investigations into Trump and his actions or business practices by the Manhattan district attorney, the New York state attorney general, the Fulton County, Ga., district attorney, and the U.S. Department of Justice.

Latest developments:

Trump’s attorney Joe Tacopina denounced the indictment of former President Trump as a “double standard,” suggesting that the filing of criminal charges against the former president “endangers all of us.”

Trump’s 2024 presidential campaign launched a barrage of indictment-themed fundraising emails shortly after the grand jury in Manhattan on Thursday voted to make Trump the first sitting or former U.S. president to be indicted in American history.

Trump’s campaign received over $4 million in donations within 24 hours of the indictment being announced.

Nashville school shooting

Key people: Audrey Hale, Katherine Koonce, Cynthia Peak, Mike Hill, Evelyn Dieckhaus

Background:

On Monday, Audrey Hale opened fire at The Covenant School in Nashville, killing three children and three adults.

Hale was a former student of the school and had conducted surveillance of the building prior to the shooting.

Hale identified as transgender and had used masculine pronouns on social media.

The shooting was the 129th mass shooting in the U.S. in 2023, with 37 having been committed in March, according to the Gun Violence Archive.

Latest developments:

Authorities released 911 recordings on Thursday that captured the terror inside the school during the shooting.

The Trans Radical Activist Network (TRAN) has vowed to go ahead with their “Trans Day of Vengeance” rally in Washington D.C. despite the shooting.

Senator Rick Scott called for an “automatic death penalty” for school shooters.

The shooting has provoked discussion and debate from both sides of the political divide, with some calling for gun control measures and others focusing on the shooter’s reported gender identity.

Banking turmoil

Key people: Andrew Bailey, Kevin McCarthy, Sarah Walker, Luis Mayorga, Igor Fayermark

Background:

Bank shares rebounded after First Citizens BancShares Inc announced it would acquire the deposits and loans of Silicon Valley Bank.

Small businesses scrutinized their banking services and considered making changes to ensure their money is safe after the collapse of Silicon Valley Bank and Signature Bank.

Latest developments:

Deposits at all U.S. commercial banks fell in the week ended March 22 to their lowest since August, but at a slower rate than the week before, and stabilized at small lenders seen as more vulnerable to outflows after the failure of Silicon Valley Bank.

March recorded the worst U.S. bank failures since the 2008 crisis, but some investors snapped up battered financial stocks to bolster their bets on the sector’s long-term health.

The Federal Deposit Insurance Corporation (FDIC) has retained advisers to sell the securities portfolios that the new owners of failed Silicon Valley Bank and Signature Bank rejected.